Home Energy Rebate Programs Summary

News and Information about the upcoming Home Energy Performance-Based Whole-House Rebates or HOMES.

for Maryland Homeowners

Perspective on the Inflation Reduction Act

As a certified and licensed local Maryland home performance contractor, I am really excited about the Inflation Reduction Act. The part that gets me going the most is the Home Energy Rebate Program.

Many of my Maryland friends and neighbors are about to go through a transformation in the way that they think about their homes. I went through the change in 2017, but it is still fresh in my mind.

What You Should Be on the Lookout For

Updated 7/31/23

Outline of the program can be found here with more information (came out 7/27/23)

Outline of the program can be found here with more information (came out 7/27/23)

Will Maryland get on the fast track and be able to get the program going by the end of 2023?

Will Maryland get on the fast track and be able to get the program going by the end of 2023?

Income-verified rebates at the point of sale.

Income-verified rebates at the point of sale.

Hearing more about getting a home energy audit (whole-house assessment).

Hearing more about getting a home energy audit (whole-house assessment).

States have from now until January 31, 2025 to request funds for program implementation.

States have from now until January 31, 2025 to request funds for program implementation.

Legitimate text messages from Maryland with links to apply and learn more.

Legitimate text messages from Maryland with links to apply and learn more.

Reduced costs for home energy audits so you can get proper guidance.

Reduced costs for home energy audits so you can get proper guidance.

A whole-house performance assessment is a big part of the Home Energy Rebate Programs

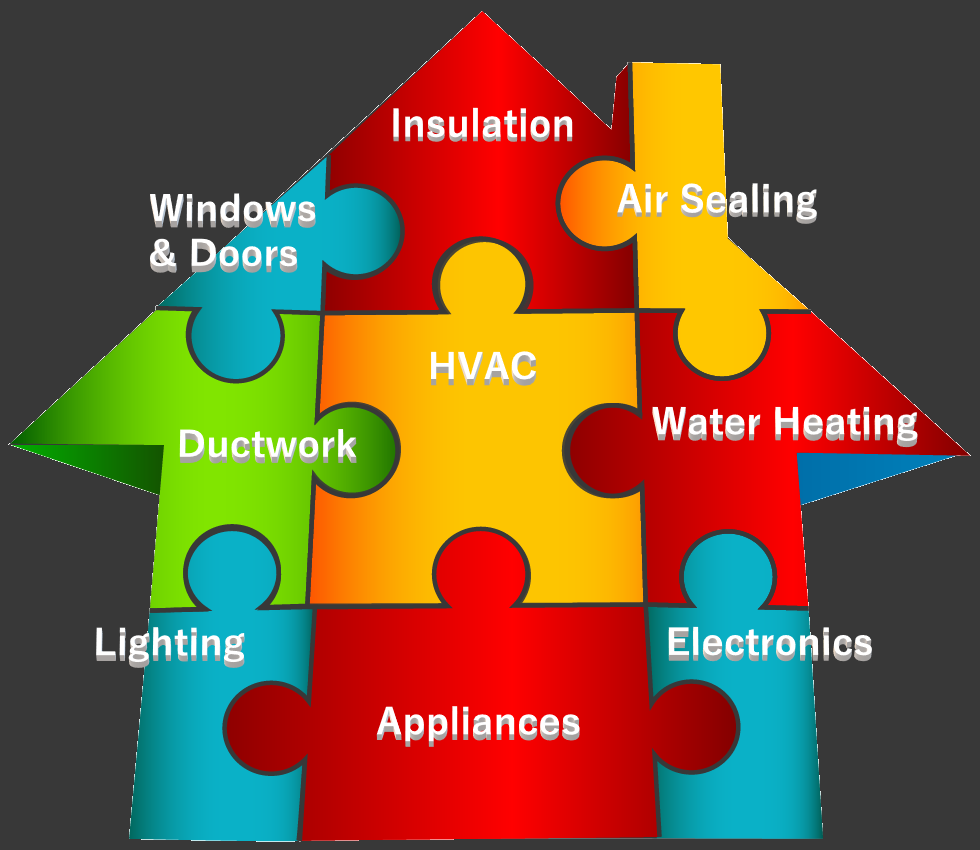

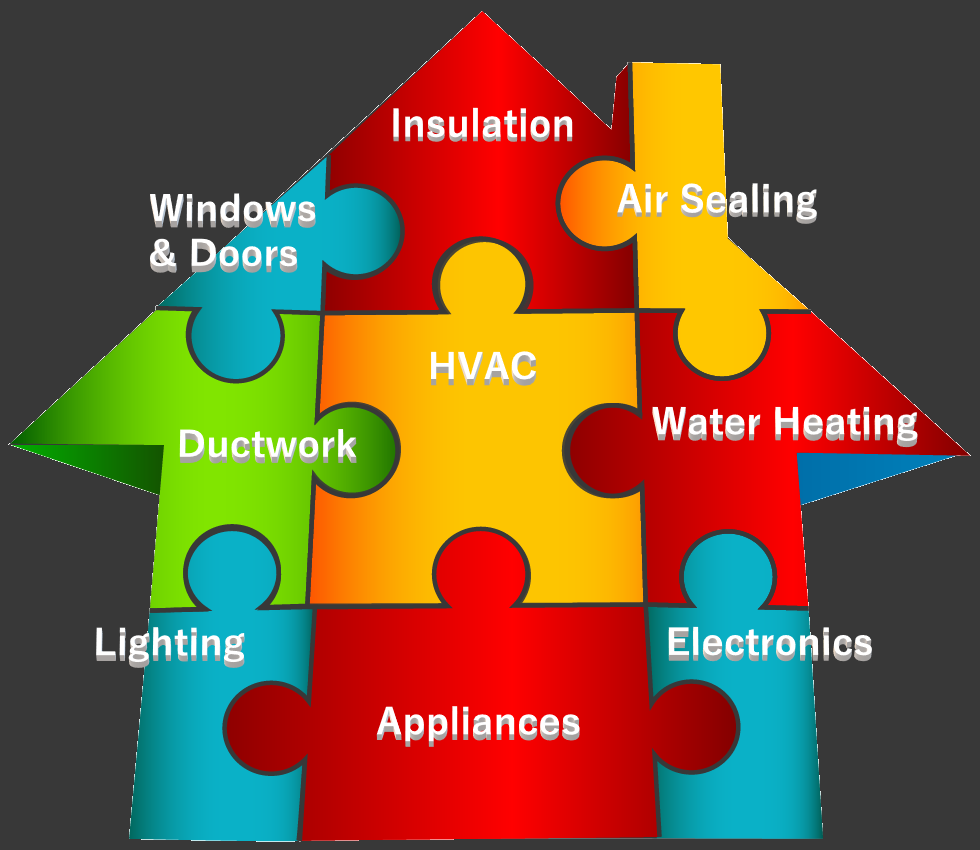

Insulation (more appropriately, Home Performance) is not nearly as famous as replacement windows, yet it is significantly more impactful. Using a house as a system approach can improve comfort and energy efficiency more than any other improvement.

"Along with incredible incentives to help reduce out-of-pocket costs, the biggest benefits to Maryland homeowners will be better comfort and lower energy usage."

Home performance is part science and part "dirty" work. The most important places to seal and insulate a home are dusty attics, dingy basements, and crawl spaces.

It is due to how heat, wind, and pressure move the air inside and outside your home. As luck would have it, those places need the most attention!

Home performance will become a household name over the next ten years. Along with incredible incentives to help reduce out-of-pocket costs, the most significant benefits to Maryland homeowners will be better comfort and lower energy usage.

Inflation Reduction Act Rollout Timeline for Maryland

As of 5/6/2023, it looks like the Maryland Energy Administration (MEA) is on top of things, and they are up to date with submittals to the Department of Energy for funding.

MEA has a webpage that details the Inflation Reduction Act progress for Maryland, and they are also trying to land on a date when the incentives will be available.

For now, it looks like towards the end of 2023, the first part of 2024.

What Exactly is the Inflation Reduction Act?

The Inflation Reduction Act includes several incentivized programs to promote energy efficiency and combat climate change.

Insulation and Air Sealing

The Inflation Reduction Act provides tax credits and rebates for a range of home improvements that reduce energy leakage – keeping homes warmer in the winter and cooler in the summer and saving money on utility bills. Insulation material can lower heating and cooling costs by up to 20%, and air sealing (like caulking and weather-stripping) save energy and improve air quality by keeping moisture out. In addition to supporting the upgrades themselves, the Inflation Reduction Act can also cover the costs of home energy audits so that an inspector can identify the best improvement options.

This is taken from the White House Website

It will start with Energy Audit Inspections that may lead to Home Performance retrofitting for measured (modeled) results.

Examples include:

-Air Sealing

-Insulation

-Duct Sealing

There are two significant parts of the Inflation Reduction Act. Avoid going down the wrong rabbit hole of replacing HVAC immediately. Don't make the mistake of putting a brand-new engine (HVAC) into a leaky boat (your house).

1st BIG PART: Reduce Energy Consumption - Home Efficiency Rebates

(Home Energy Performance-Based, Whole-House Rebates)

One of the best ways to impact how much energy we use is to tighten up our buildings with sealing and insulation so that the heating and cooling system does not have to run as much.

2nd BIG PART: Electrification - Carbon Footprint - Home Electrification and Appliance Rebates

2nd BIG PART: Electrification - Carbon Footprint - Home Electrification and Appliance Rebates

(High-Efficiency Electric Home Rebate Program)

The process of strategically (end-of-life machines) replacing combustion furnaces/appliances with all-electric versions that use clean energy.

Do You Qualify for Inflation Reduction Act Rebates?

Total Funding: $4.3 Billion (available through September 2031 or until used up)

Maryland's Piece of the Pie: $136,823,600.00

Home Energy Performance-Based, Whole-House Rebate Allocations: $68,611,060

High-Efficiency Electric Home Rebate Allocations: $68,212,540

Home Energy Performance-Based, Whole-House Retrofits

- Home Efficiency Rebates for Home Energy Performance-Based Whole-House projects are available for all homeowners in Maryland

- Rebates are doubled for low- and moderate-income individuals making less than 80% of area medium income (AMI).

- FIND YOUR AMI HERE

The area median income is the midpoint of a region's income distribution. So, half of the households in a region earn more than the median, and half earn less. Household income is calculated by its gross income, which is total income before taxes and other payroll deductions.

- Contractors providing retrofits through the program can also claim a $200 rebate per home they service in an underserved community.

- IRA prohibits combining this program rebates with any other Federal grant or rebate - including the new High-Efficiency Electric Home Rebate Program

- IRA allows you to combine rebates with current BGE and Pepco Home Performance with ENERGY STAR rebates! Yay!!

- IRA allows you to combine rebates with federal tax credits like 25C (Energy Efficiency Home Improvement Credit) Double-Yay!!

How Maryland Homeowners Can Take Advantage of the Inflation Reduction Act

Maryland will be quick to the punch because we already have a great program. A modeled energy savings pathway is calibrated to a home's historical energy usage and can be pretty accurate.

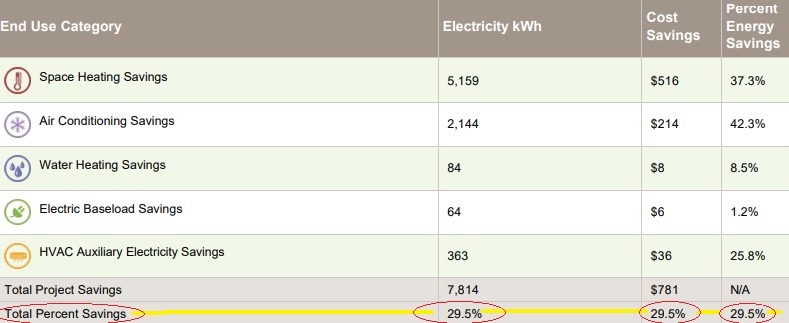

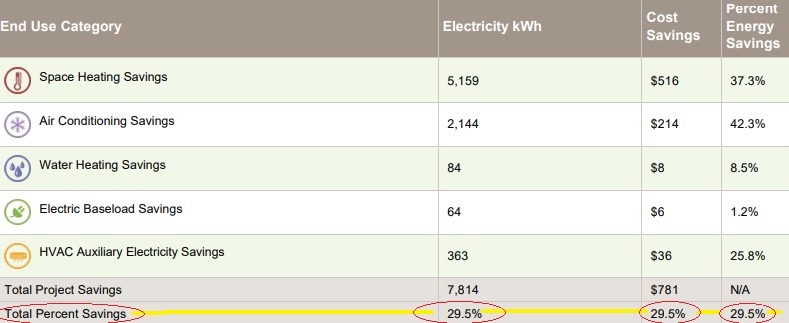

Example of a modeled house through the existing Maryland Home Performance with ENERGY STAR® Program

Inflation Reduction Act Rebates Modeled Pathway

| PROJECTED ENERGY SAVINGS |

SINGLE-FAMILY |

| 20-35 PERCENT |

$2000 OR 50% OF THE PROJECT COST

(whichever is less)

For low- and moderate-income (AMI) individuals,

$4000 or 80% OF THE PROJECT COST

(whichever is less)

|

| OVER 35% |

$4000 OR 50% OF THE PROJECT COST for (AMI) individuals, $8000 or 80% of the project cost (whichever is less)

|

So let's look at an example to see how this could impact you.

I have a friend that lives in Baltimore County, Maryland. The AMI for her address is $116,100. Her household income is $67,300, or 58% of the median income for her area.

She recently had an energy audit done, and the modeled results indicated that sealing and adding insulation would save her 20% on her energy bill annually.

The total cost to perform the services needed to make the home more efficient is $13,345.00.

Here is how this friends scenario would look:

Home Performance Contract $13345.00

IRA Rebate $4000.00

BGE Rebate $5991.59

Out Of Pocket $3353.41

Federal Tax Credit 25C -$1200.00

Total Project Cost $2153.41

WATCH A HOME PERFORMANCE PROJECT VIDEO

Check out a HOME PERFORMANCE job and the measured results.

Whole house solutions look to seal your house so your HVAC works less - saving you energy.

This bill provision incorporated elements of legislation that Maryland lawmakers voted for called “HOPE for HOMES.”

U.S. Sen. Chris Van Hollen said there are “tremendous savings” in using energy more efficiently.

He pointed to the up-front cost as the biggest hold-up to a homeowner making improvements in their home to lower energy usage.

Sometimes the up-front costs overshadow the savings gained over time, and the 2022 bill makes getting the work done more attractive and affordable.

Under the Inflation Reduction Act, many homeowners can recoup up to 50% of energy improvement costs — up to a maximum rebate of $4,000. Lower median-income homeowners could be eligible for more generous rebates of up to 80% of costs, a maximum of $8,000.

Additional Rebates & Training Grants

High-Efficiency Electric Home Rebate Program

-

Rebates for low and moderate-income homeowners for electric system/appliance purchases and energy efficiency upgrades

-

The rebate program for the High-Efficiency Electric Home Rebates will only be available for those that meet the income qualifications of the program (only households with an income below 150% AMI are eligible).

-

Maximum rebate of $14,000; individual rebates are as follows:

-

Heat pump water heaters: $1,750

-

Heat pump HVAC systems: $8,000

-

Electric stoves: $840

-

Heat pump clothes dryers: $840

-

Electrical panel upgrades: $4,000

-

Insulation, air sealing, and ventilation: $1,600

-

Electric wiring: $2,500

-

Rebates cannot be combined with other federal grants or rebates

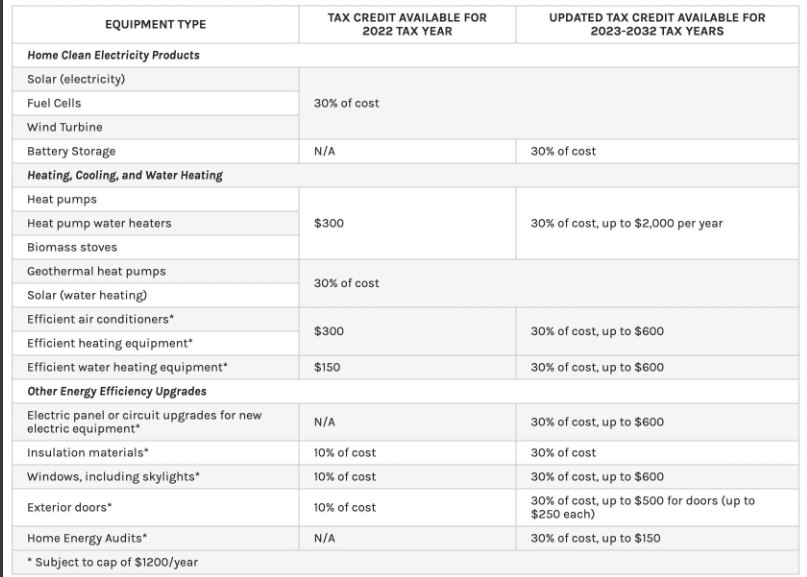

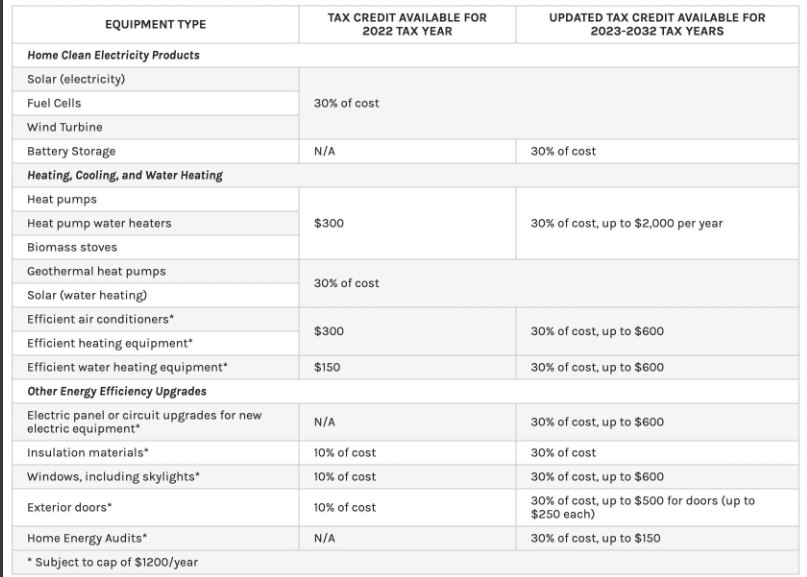

Inflation Reduction Act Tax Credits

More immediately, the new bill makes changes to tax credits for energy efficiency upgrades.

25C Tax Credit - Energy Efficiency Home Improvements (The Nonbusiness Energy Property Tax Credit)

-

Credit revived and made retroactive for 2022 (at original 10%). It went away and it is back!

-

Starting in 2023, the credit increases to 30% of total installation costs through 2032

-

The current lifetime cap of $500 will be replaced by a cap of $600 per measure, with a $1,200 annual total limit (exceptions listed below)

-

Eligible services and home improvements include:

-

Heat pumps and heat pump water heaters ($2,000 credit)

-

Insulation and air sealing

-

Energy audits ($150 credit)

-

Energy-efficient HVAC systems (including furnaces, boilers, and central AC)

-

Electrical panel upgrades

-

Energy-efficient windows and doors ($500 credit for doors)

-

Roofs are no longer eligible

Stay Informed About the Inflation Reduction Act

Subscribe to my blog or revisit for updates as they piece things together. We watch this daily.

Home performance work makes the difference in energy savings and better home comfort.

What is missing in your attic?

2nd BIG PART: Electrification - Carbon Footprint - Home Electrification and Appliance Rebates

2nd BIG PART: Electrification - Carbon Footprint - Home Electrification and Appliance Rebates